Case Studies

Case 2

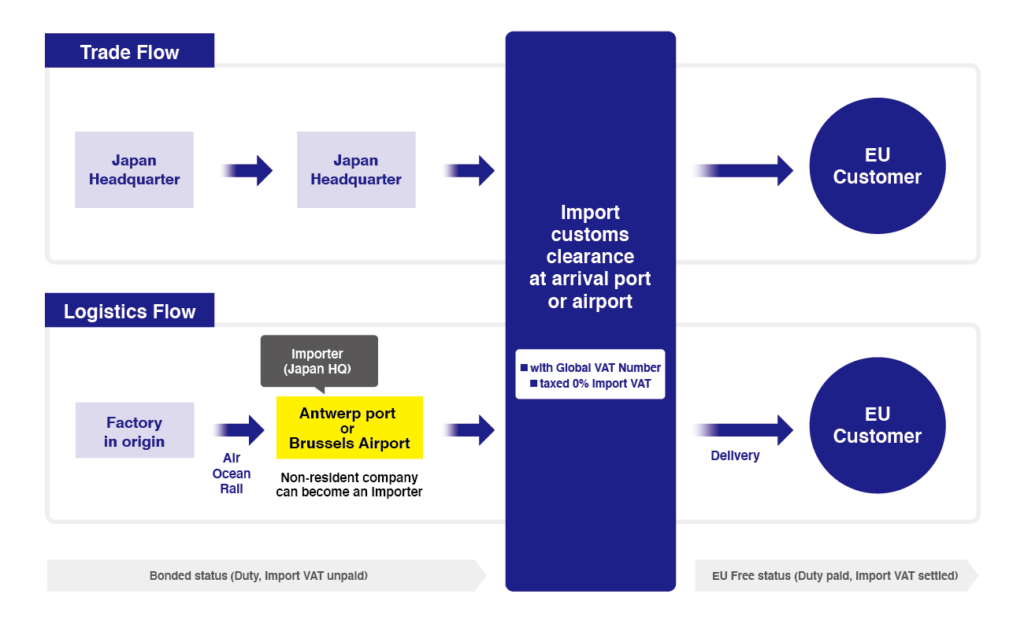

DDP business to EU customers

Issue

Example of Company C

Company C is a company established in the USA. Company C exports products to its customers in EU member countries. Company C was requested by its EU customers to change its terms of trade to DDP. Under DDP terms the supplier (=company C) should be an importer and arrange import clearance, however company C did not have entities in EU member countries.

Solution

We proposed transportation via Antwerp port / Brussels airport utilizing the Belgian Limited Fiscal Representative system.

A company which is not established in Belgium can also be an importer that utilizes the Belgian Limited fiscal representative system. This meant that company C could be an importer into Belgium and could transact business on DDP terms just as its competitors in Europe do.