Case Studies

Case 6

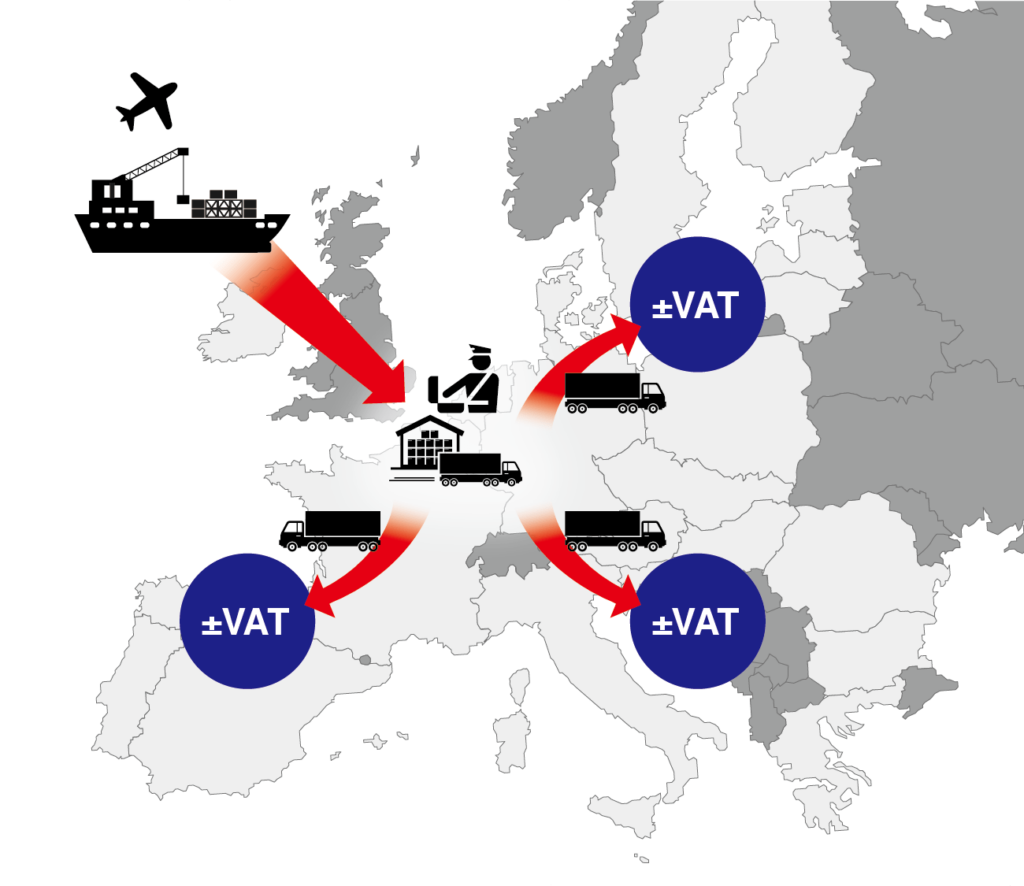

Stock with bonded status

Issue

Example of Company G

Company G is a subsidiary of a Japanese company and is established in Dusseldorf, Germany. Company G had stock in a warehouse in Hamburg, and sold the goods to its customers in EU member countries. However Company G had cash flow problems because import duties and VAT had to be paid on all its products in a container when it arrived at the warehouse.

Solution

We proposed the non-resident inventory & bonded stock operation at our warehouse in Antwerp, Belgium.

A company which is not established in Belgium may nevertheless have stock in Belgium, and there is no deadline for import customs clearance in relation to bonded stock in Belgium. By utilizing the Belgian Limited Fiscal Representative System, company G could clear customs at the time when their product was sold. As a result, cash flows resulting in import duties were minimized. In addition, by utilizing intra-community transactions in the EU or the VAT warehouse system in Belgium, company G could avoid payment of import VAT.